5 Ways to Start Your Kid on Financial Literacy

Financial literacy for kids aged 6-11 years old is crucial for their long-term financial well-being. As parents and educators, teaching primary school students money management concepts lays a solid foundation that prepares them to make informed financial decisions throughout their lives. This guide explores five practical ways to initiate early financial education and empower your child with essential money management skills.

1. Understanding the Basics of Money

Understanding what money is and how it functions is fundamental to early financial education. Money is more than just coins and notes—it’s a tool we use to buy goods and services. For young children, explaining the concept of money in relatable terms is crucial. You can start by illustrating different forms of money, such as coins, banknotes, or even digital payments like cards or apps.

Imagine taking your child to the grocery store. Point out how you use money to pay for groceries. Discuss with them the idea that money represents value—it’s what allows us to buy things we need, like food, and things we want, like toys.

How to Say it:

Parent: “We’re going shopping today. Do you know how we are going to pay for our food? We’re going to use money.

Child: “What is money?”

Parent: “See these coins and notes here? These are what we are going to use to pay for our food.”

Parent: “Can you tell me how much money I have?”

Child: “You have one $10 note and two 50 cent coins!”

Parent: “You’re right! The total cost of our food is $6. We’re going to pay using the $10 note now. Seller is going to give us some change. Let’s count the change together, okay.”

Child: “The seller gave us two $2 notes for change! Two dollars plus two dollars equals four dollars.”

Parent: “Very good! Let’s keep our change in our purse, and walk home to eat our food.”

Understanding the basics of money sets the stage for more advanced financial concepts. It teaches children the value of money and introduces them to the concept of financial transactions.

2. Distinguishing Between Needs and Wants

Learning to differentiate between needs and wants is a critical aspect of money management for children. Needs are essential for survival and well-being, such as food, clothing, and shelter. Wants, on the other hand, are things that make life more enjoyable but are not necessary for survival, like toys, games, and treats.

During a family discussion or classroom activity, create a list of items and categorise them as needs or wants. For instance, ask children if having a new video game is a need or a want. This exercise helps them understand that needs must be met before wants and encourages them to prioritise their spending.

How to Say it:

Child: “Can we buy that new toy car I saw today?”

Parent: “Let’s think about it. Is the toy car a need or a want?”

Child: “It’s a want because it’s just for fun.”

Parent: “Good job! Remember, we need to take care of our needs first. How about we save up some money from your allowance to buy the toy later?”

Child: “Okay, I can do that!”

Parent: “That’s a great plan. Learning to save for wants is a smart way to manage money.”

Teaching children to distinguish between needs and wants promotes responsible decision-making and helps them develop a balanced approach to spending money.

3. Creating a Simple Budget

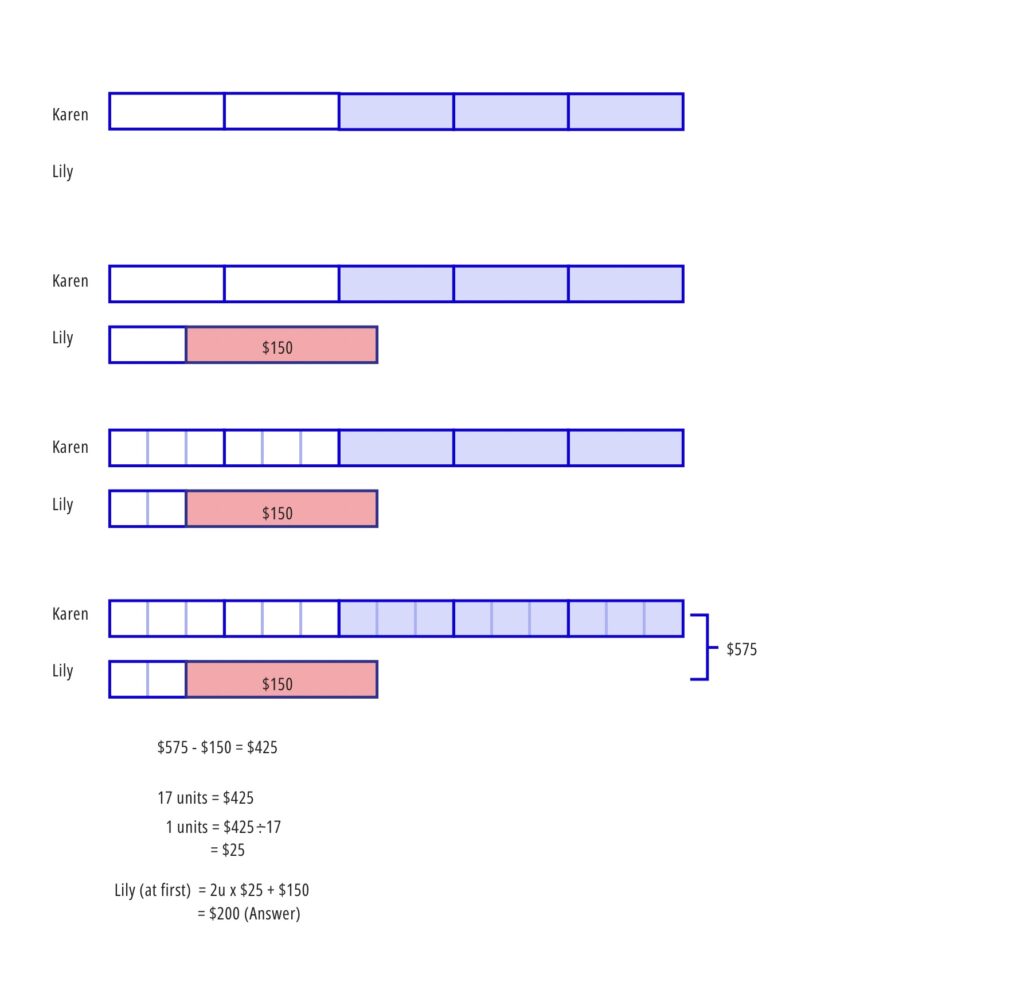

Introducing budgeting to children is an effective way to instil money management for children. A budget is a plan for how you will spend and save your money. Simplify the concept by starting with their pocket money or allowance. Discuss with them how much they receive and help them allocate portions for saving, spending, and perhaps giving to others.

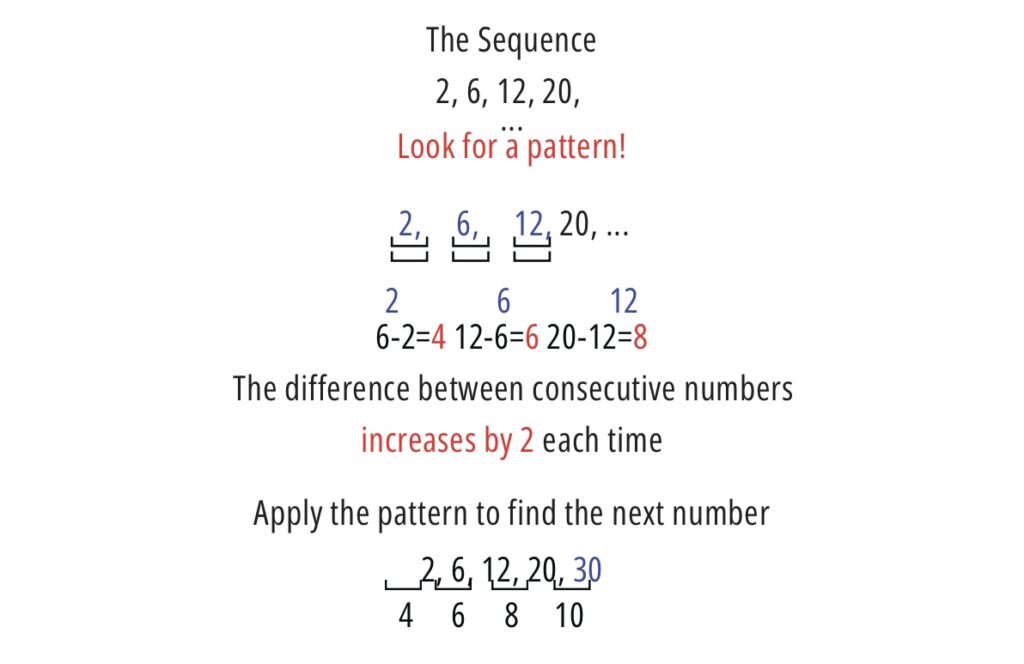

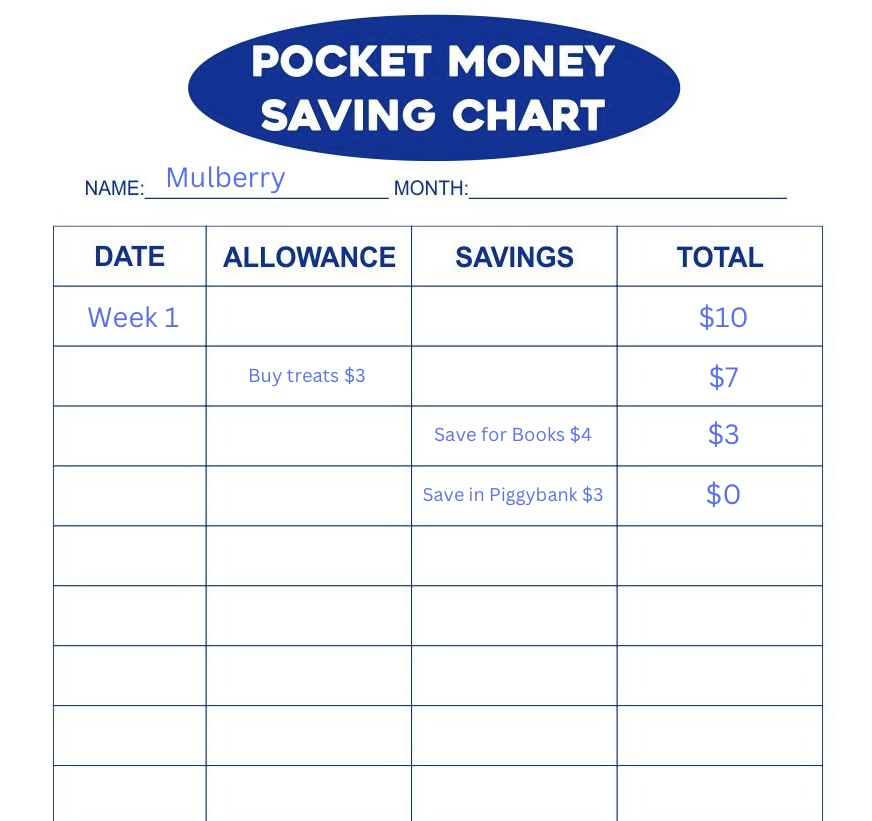

Sit down with your child at the beginning of the month or week to plan their budget. If they receive $10 a week as pocket money, discuss how much they might want to save for a toy they’ve been wanting and how much they can spend on treats or other items throughout the week. Use a diagram or chart to show your child for easier visualisation.

How to Say it:

Parent: “Let’s make a plan for your pocket money. How much do you get each week?”

Child: “I get $10!”

Parent: “Great! How about we save $4 for your new book, spend $3 on treats, and put $3 in your piggy bank?”

Child: “Okay! I want to save for that book I saw at the store.”

Creating a simple budget encourages children to think ahead, set financial goals, and learn the value of planning and saving for future needs and wants.

4. Setting Up a Savings Account

Setting up a savings account for your child is a practical step towards early financial education. Many banks offer special savings accounts designed for children. Take your child to the bank to open an account and explain how it works. Encourage them to deposit a portion of their allowance or monetary gifts they receive into the account regularly.

Discuss with your child what they might want to save for—a new bicycle, a favourite toy, or even a family outing. Show them how putting money into their savings account regularly can help them reach their goal faster. Check the account periodically together to see how their savings grow.

How to Say it:

Parent: “Guess what? We can open a special account just for you to keep the money that you save! It’s called a savings account.”

Child: “Wow, like a bank account?”

Parent: “Exactly! We can put some of your birthday money in there, and it will grow over time. What would you like to save for?”

Child: “I want to save for a LEGO set!”

Setting up a savings account teaches children the importance of saving money for future goals, introduces them to banking concepts, and helps them develop good financial habits from an early age.

5. Learning Through Play and Practical Activities

Making learning about money management for children engaging through play and practical activities makes the learning process enjoyable and effective. There are various games, apps, and simulations designed to teach children about money in a fun and interactive way.

Play “store” at home where children take turns being the shopkeeper and customer. Use play money or real coins to simulate buying and selling items. Assign prices to items and encourage them to calculate change.

How to Say it:

Parent: “Let’s play a game. You be the shopkeeper, and I’ll be the customer. How much does this toy car cost?”

Child: “It’s $2!”

Parent: “Okay, here’s $5. How much change should I get back?”

Child: “You should get $3 back!”

Parent: “Well done! You’re great at this!”

This activity not only reinforces basic math skills but also introduces concepts of budgeting and spending wisely which are important in early financial education. These tools provide hands-on experience and practical knowledge that children can apply in real-life situations.

Conclusion

Teaching early financial education through practical and engaging methods is essential for their future financial well-being. Introducing them to basic money concepts, teaching them to distinguish between needs and wants, creating simple budgets, setting up savings accounts, and learning through play are all valuable ways to initiate money management for children.

Empower your child with essential money management skills by exploring more resources and activities on financial literacy for kids. Let in:genius helps you guide your child towards financial success. Investing in early financial education today ensures a brighter financial future for your child tomorrow.